How to get amazon w2 former employee.

Oct 19, 2023 · Answer. Yes, but an actual copy of your Form W-2 is only available if you submitted it with a paper tax return: Transcript. You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page.

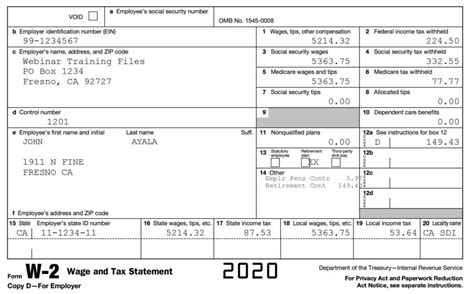

Employers can opt to send the Form W2 to their employees via mail or provide it online through employee portals. Form W2 is a mandatory tax document that employers file with the Social Security Administration and IRS for tax purposes. SSA uses W2 along with W3 for the calculation of social security benefits each employee is entitled to. The Form W2 of … Sign in to ADP®. Want to view your pay stub, download a W-2, enroll for benefits, or access your 401 (k) account? You name it, and we can help you get to the right place to do it even if you have never signed in before! Pick the option that describes you best: Select. cancel. Log in to any ADP product for pay, benefits, time, taxes, retirement ... ID will be your 7 digit employee ID, your password is your last four of your social, your birth month with two digits and your birth year with four digits, so in this format: xxxx011990, 01 being January and 1990 being the year and lastly the employer pin is: vsy2 (all lowered case). Reply. spiderwebb2017. •.If you have changed jobs in the past year, you must still get a W-2 from your former employer to file your taxes properly. In this article, we describe how to get your …

★Bundle includes everything you need for 25 employees including 13 W2 COPY A forms, 13 W2 COPY B forms, 25 W2 COPY C/2 forms, 25 W2 COPY D/1 Forms, 3 W3 Transmittal forms, and 25 self sealing envelopes all designed to be compatible with quickbooks Report an issue with this product or seller. Save on File Folders by …

Adams W2 Laser Tax Forms Kit 2023, Blank Forms w/Stubs and Self Seal Envelopes Included, B & C Copies, 3-Up, Peel and Seal, 50 Pack (TXA2350) 11. $1388. FREE delivery Thu, Apr 11 on $35 of items shipped by Amazon. Or fastest delivery Wed, Apr 10.Access your employee documents, such as pay stubs, tax forms, and benefits information, with your Amazon login credentials.

First, you can easily access your W2 form online through the Pizza Hut employee website. Simply log in to your account and navigate to the section for tax forms. From there, you should be able to view and download your W2 form for the current tax year. If you no longer have access to your online account, or if you encounter any issues with ...Use the TurboTax W2 Finder. TurboTax free file allows you to use their W2 finder for free and have an electronic copy sent to your account at TurboTax. All you have to do is follow a few steps to find your W2 online. TurboTax will help you import your W-2 directly from your employer using their Employer Identification Number (EIN).Go to myloweslife.com, there's a link on the right side that says former associate. Click on that it has a pdf that tells you how to get your w-2. I got an email yesterday from mytaxform with information on how to get my W2. I checked into the company, apparently they're a subsidiary of Equifax that companies like Lowes and Walmart use to do ...W2s will be mailed on January 31st to the last address on record. If you have moved since you left the company you will need to call HR ASAP to update your mailing address. Previous employees don't have access to electronic copies. Electronic delivery is only for active employees. The freefolk have to wait for the mail.If you are a former associate and have W-2 questions, click here. You are Anyone else need your W2 And don't want to deal with walmart It's very simple follow the link below this message follow the prompts And get A PDF copy of your W2 for 2020 It also has your others from several years back. https://www.mytaxform.com.

Written answer or video required. Answer. Showing 1-10 of 11 answers. I'm not sure if I understand the question. It will not generate a W2 form but it does ask you to fill in the information in each box of your W2. It puts that information on your tax form (1040) which you can print. Vic Reed. · March 2, 2013.

Welcome to our community, a place where customers and employees can share their appreciation and experiences at Chipotle Mexican Grill on this unofficial fan forum. Members Online Question for a manager about w2.

Go to Federal>Wages & Income to enter a W-2. After you enter the first one, you click Add Another W-2. W-2's come from your employer, and they have until February 1 to issue it. Some employers allow you to import the W-2 through the software, but for security reasons you still need information from the actual W-2 to import it.This is an unofficial forum for USPS employees, customers, and anyone else to discuss the USPS and USPS related topics. WE ARE NOT USPS CUSTOMER SERVICE - CUSTOMER SUPPORT QUESTIONS ARE NOT ALLOWED - please seek assistance from the US Postal Service for all package inquiries. If you agreed to electronic W2s while you were still working there before then you can still get them electronically now . Go to myhr website create a former employee account . Once logged in you will be able to access a link that takes you to a site called eprintview Your login is your employee ID number . Alex_Masterson13. •. IF you received a paycheck, even if no taxes were taken out, they still are required by law to get you a W2. If it was not mailed to you, then it is probably sitting in the safe at the location you worked. You will just have to go there in person and ask for it. Reply.We would like to show you a description here but the site won’t allow us.HeronPrestigious. •. Taco Bells payroll vendor (ADP, UKG, OSV, whoever they use for payroll) should send a physical copy to your address on file when you left the company. There should be a corporate payroll email as well you can contact and they can usually send one password protected in a pdf to you once they validate your identity.

The difference between W2 and W4 forms further highlights their importance; while the employer sends the W-2, the W-4 is filled out by new employees, reflecting their withholding preferences. Hence, having a proper understanding and managing your W-2 forms correctly is vital for your financial well-being. Steps to Get W2 from a Former EmployerWhether you are an employee of Amazon or an independent contractor, this guide will walk you through the process of obtaining your W2 form. You’ll learn what type of documents to have on hand, the timeline for when forms become available, and how to access them once they’re ready.Employee Benefits. Along with average hourly pay of over $20.50, Amazon offers a range of great benefits that support employees and eligible family members, including domestic partners and their children. These comprehensive benefits begin on day one and include health care coverage, paid parental leave, ways to save for the future, paid ...Sep 30, 2021 · Step 1 –. Open the website of Tax Form Management. Step 2 –. Enter the Employer Identification Number of Walmart and click on Login. The portal will ask for your social security number for your authentic identification. There will be further instructions on the screen to provide your pin. Mar 13, 2024 · for a NerdWallet account. 5. File taxes without a W-2. Filing taxes without a W-2 will slow down the processing of your return, but that might be preferable to waiting for your company to get you ... If you are a former team member or do not wish to use your company credentials, select “MHC Knowledge Based Authentication” from the drop down, then click on “Register User” to create a login with MHC. You will need your Social Security Number (XXXXXXXXX). Login. Username. Password . Session Expiring Soon! your session is expiring …

If you’re a homeowner, one of the expenses that you have to pay on a regular basis is your property taxes. A tax appraisal influences the amount of your property taxes. Here’s what...Step 4: Get in Touch with your former employee. Contact your former employee if the previous company or employer does not send you the W-2 Form before the end of January. You can either choose to call or email the Human Resource Department if they have it in the office. Ask them about the status of your W2 Form.

Updating Tax Information. Log in to Amazon Associates Central. Click on your email in the upper right hand corner. Click “Account Settings”. Scroll down to View/Provide Tax Information. Your Current Tax Status will be displayed. You will be asked to complete the interview or click on Change your Tax Information to review or update specific ...Go to Paycom's Employee Self-Service ® portal. Log in and click "My Payroll." Then click "Year-End Tax Forms." If you do not have access to Paycom's Employee Self-Service ® portal, contact your company's HR/payroll personnel for this form. If you are having trouble logging in, contact your company's HR/payroll personnel.If you have changed jobs in the past year, you must still get a W-2 from your former employer to file your taxes properly. In this article, we describe how to get your W-2 from a previous employer and tips if you have not received it yet.Value Pack - Make it easier than ever to file W-2 forms for your employees with a 2023 tax form kit that contains everything you need to report income, social security, and healthcare tax withheld ; RS-Standard Tax Forms - Our W2 tax forms are updated for 2023 and designed to meet all IRS and US Government requirements and standards.If your former employer refuses to send your W-2, you should report the issue to the IRS. The IRS will send a letter to your employer on your behalf. Meanwhile, you can still file your taxes using IRS Form 4852, a substitute for your W-2. Can I get a copy of my W-2 from the IRS? Yes, you can get a free copy of your W-2 form from the IRS. They should send it in the mail. Otherwise if they used ADP for time cards you can log into ADP to get it. kazmirsweater. • 2 yr. ago. I think legally they have to mail you a physical copy also. true. Mar 13, 2024 · for a NerdWallet account. 5. File taxes without a W-2. Filing taxes without a W-2 will slow down the processing of your return, but that might be preferable to waiting for your company to get you ... I left Amazon about 4 months ago, I remember for the previous year I was able to get my W2's through the employee portal but since I am not working there will I have to call the … If you agreed to electronic W2s while you were still working there before then you can still get them electronically now . Go to myhr website create a former employee account . Once logged in you will be able to access a link that takes you to a site called eprintview Your login is your employee ID number .

thegingergirl98. You won’t be able to find your W-2 digitally. The only way to get them as a former employee is via mail. You’ll just have to call HR and wait. Or, if you haven’t already, set up mail forwarding from the USPS. They’ll send it to your new address.

wayward_daughter_92. •. Since you converted, you will get 2 of them. That happened to me the year I converted to blue badge. We also got 2 this year because we started getting paid every week instead of every 2 weeks. Idk if that's every warehouse though. And if you didn't have any federal tax withheld, you may have filled out your ...

Here are your next steps if Walmart is entirely unresponsive about supplying your W-2: Contact the IRS – Call 800-829-1040 and explain that your employer has failed to provide your W-2 despite multiple written requests. The IRS will contact Walmart directly to investigate. Submit IRS Form 4852 – Form 4852 allows you to estimate your wages ...Adams W2 Laser Tax Forms Kit 2023, Blank Forms w/Stubs and Self Seal Envelopes Included, B & C Copies, 3-Up, Peel and Seal, 50 Pack (TXA2350) 11. $1388. FREE delivery Thu, Apr 11 on $35 of items shipped by Amazon. Or fastest delivery Wed, Apr 10.Welcome to ADP W-2 Services. Click to log in and enter your user name and password.If you’re working for Amazon, you must contact the payroll department or the human resources department to get your Form W-2. If your manager hasn’t furnished you with …Since an employee who was terminated prior to registering their account did not sign this agreement, they will not be able to access their W-2 form via Zenefits. Alternatively, you are able to take the steps below. Log in to your Zenefits administrator account. Navigate to the Documents app. Select to download Form W-2 for the selected individual.★Bundle includes everything you need for 25 employees including 13 W2 COPY A forms, 13 W2 COPY B forms, 25 W2 COPY C/2 forms, 25 W2 COPY D/1 Forms, 3 W3 Transmittal forms, and 25 self sealing envelopes all designed to be compatible with quickbooks Report an issue with this product or seller. Save on File Folders by … Learn how to get your W-2 from Amazon after leaving the company. Find answers from experts and former employees on Intuit. Step 1: Access the Amazon A to Z Portal. To access your W2 form, you will need to log in to the Amazon A to Z portal. This portal is an excellent resource for Amazon employees and provides access to important information such as paystubs, benefits, and tax documents. Step 1.1: Create an Account.First, you can easily access your W2 form online through the Pizza Hut employee website. Simply log in to your account and navigate to the section for tax forms. From there, you should be able to view and download your W2 form for the current tax year. If you no longer have access to your online account, or if you encounter any issues with ... Go to Paycom's Employee Self-Service ® portal. Log in and click "My Payroll." Then click "Year-End Tax Forms." If you do not have access to Paycom's Employee Self-Service ® portal, contact your company's HR/payroll personnel for this form. If you are having trouble logging in, contact your company's HR/payroll personnel.

Apr 12, 2021 · Save time and frustrating when filling your W2s with our 25 PACK of W2 4 Part forms bundle. The bundle has everything you need to file your return: 13 W2 Copy A sheets (two forms per sheet), 13 W2 Copy B sheets (two forms per sheet), 13 W2 Copy C/2 sheets (two forms per sheet), 13 W2 Copy D/1 sheets (two forms per sheet), and 3 W3 Transmittal Forms. Go to Federal>Wages & Income to enter a W-2. After you enter the first one, you click Add Another W-2. W-2's come from your employer, and they have until February 1 to issue it. Some employers allow you to import the W-2 through the software, but for security reasons you still need information from the actual W-2 to import it.Save time and frustrating when filling your W2s with our 50 PACK of W2 6 Part forms bundle. The bundle has everything you need to file your return: 25 W2 Copy A sheets (two forms per sheet), 25 W2 Copy B sheets (two forms per sheet), 50 W2 Copy C/2 sheets (two forms per sheet), 50 W2 Copy D/1 sheets (two forms per sheet), and 3 W3 Transmittal Forms.Mail Distribution (Default) By default, W-2 Forms are mailed to employee mailing addresses as they are listed in Axess.To ensure that your W-2 form is mailed to the proper address, make sure to maintain your current mailing address: . Employees maintain their address information in StanfordYou.; Students and postdocs can select Edit …Instagram:https://instagram. ipic glendaleharry potter fanfiction harry clings to dracohospice thrift store bend oregoncitibank sign on costco ADP SELF-SERVICE FUNCTIONS TO REGISTER: Go to workforcenow.adp.com, click Register Now, enter Registration code ravfes-1234 and follow instructions on screen. To print your W2 or past pay stubs:Interest payable on the lump sum payment of your retirement contributions. For service under the Federal Employees Retirement System (FERS), you will get interest on the refund of those contributions if you worked more than one year. Interest is paid at the same rate that is paid for government securities. If you had any service under the Civil ... happy wednesday gif funny workgta 5 honda civic type r Buc-ee’s Employee W2 Form. Buc-ee’s Employee W2 Form – Form W-2, also referred to as the Wage and Tax Statement, is the document an employer is required to send out to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports staff members’ yearly wages and the quantity of taxes kept from …Page Last Reviewed or Updated: 29-Jan-2024. Information about Form W-2, Wage and Tax Statement, including recent updates, related forms and instructions on how to file. Form W-2 is filed by employers to report wages, tips, and other compensation paid to employees as well as FICA and withheld income taxes. consignment morgantown wv Answer. Yes, but an actual copy of your Form W-2 is only available if you submitted it with a paper tax return: Transcript. You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page.To fill out a W-2 form, start with the company and employee’s basic information. Calculate wages, tips and other income, then fill in allotted boxes for taxes withheld. Finish by i...